Where most of people tired of to get a job of 25k salary, i am earning 25k per month by doing nothing. Hi everyone here i am sharing my investment journey into mutual fund through SIP. I am a middle class employee with a 40k salary in 2022. and I am glade to share with you that only after 3 yrs in 2025, now i am earning 25,000 interest per month on my investments.

So, let’s starts with begin…

Starts as Middle class employee :

This is really surprising that most of peoples of my age are looking for a JOB of 25k salary. And at same time i am earning 25k as passive income, means an extra salary of 25k in addition to my current salary from my Job.

Hello guys, Like most of indian middle class employee i am start with a basic salary of 40,000 in 2022 but i am very clear that i wanna become rich at my early age & i have to do some sacrifices with my day to day life in early stages of my life.

Since i am having knowledge about stock market from 2018, but i am a contract employee those days with only 7,000 salary with a weak back ground. But my dreams are too big I want to become Richest person in my communities. basically Rishtedaron me sabse ameer banna tha, who allredy have 1-2 crore assets(farm & Banglow).

And the journey begins, journey is very difficult but i am desperate to achieve my dream. My first step is to earn a descent amount salary.

Step-1 :: Increase Salary

I am tried everything, Govt exams like, Patwari, EO/RO, Lab assistant etc. Hard work a lot for two years And finally i am selected in Indian railways. So now I am satisfied with my 40k salary & my 1st step is completed.

Step-2 :: More Saving

Just after starting my job in Indian railways. I am very clear if i want to achieve my Big Dream, i have to save as much as i can. I mercilessly cut down all my expenses which i can. My expenses is very compromised as below :

| SALARY | 40,000 |

| House rent (sharing 6000/2) | 3000 |

| Grocery | 3000 |

| Other | 1000 |

| SAVING (80%) | 33,000 |

Where my other colleague are busy with there luxury life, Trips & costly purchases, end up with zero saving. After 3 years Now my saving gives me extra earning of 25000, that means my current income is 25k more then what my colleague earns.

Step-3 :: Investing in Mutual Fund

Because i am already having basic knowledge about stock market, mutual funds SIP & there historic returns. starts my investment journey as soon as i starts earning from 2022. I am starting with ELSS funds for tax saving.

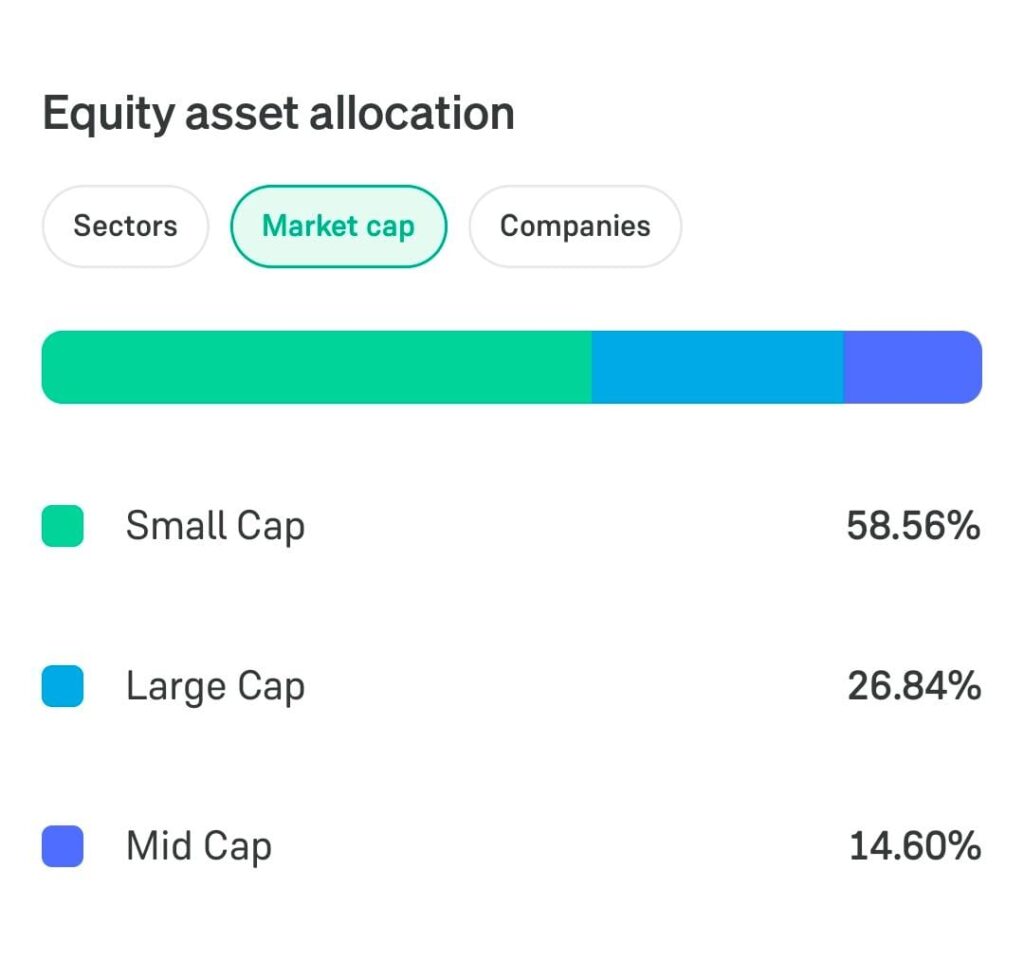

And when i switch to new tax regime. My new sip goes to Small cap funds because i am already having 50% in large cap, 30% mid cap & 20% small cap. Because my time horizon is long term so it is ok to reallocate my portfolio into 40% small cap.

Step-4 :: Increasing Investment

With increasing my salary i increase my investment. Because i am an active investor, In place of doing step-up SIP, I try to invest in Market correction as Lumpsum & it gives me some extra returns. My portfolio XIRR is more then fund returns itself.

Look once at my Journey…

MY INVESTMENTS :-

| 1) My Mutual Fund Portfolio | 13.89 Lakh |

| 2) My Stock Portfolio | 92,000 |

| 3) My NPS Portfolio | 09.59 Lakh |

| TOTAL INVESTMENT | 24.40 Lakh |

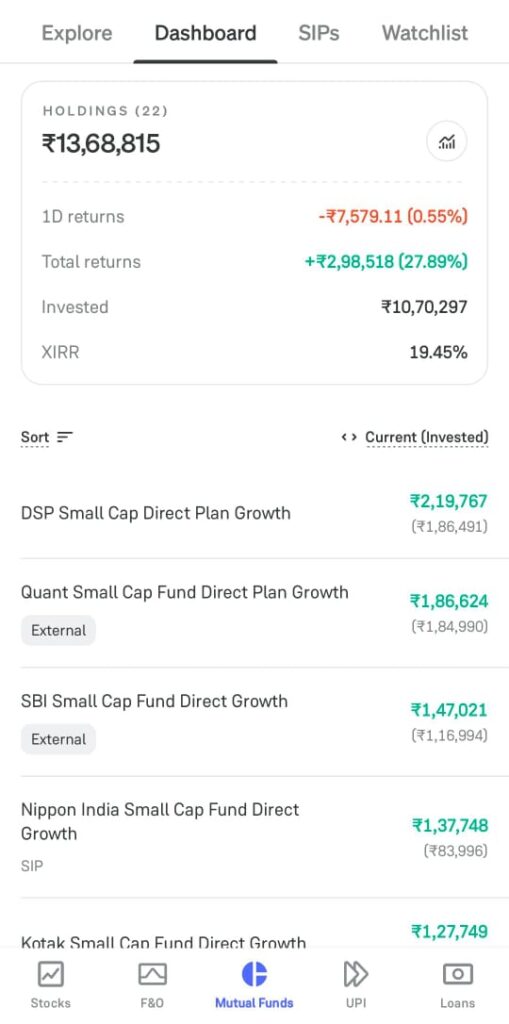

1) My Mutual Fund Portfolio :: 13.89 Lakh

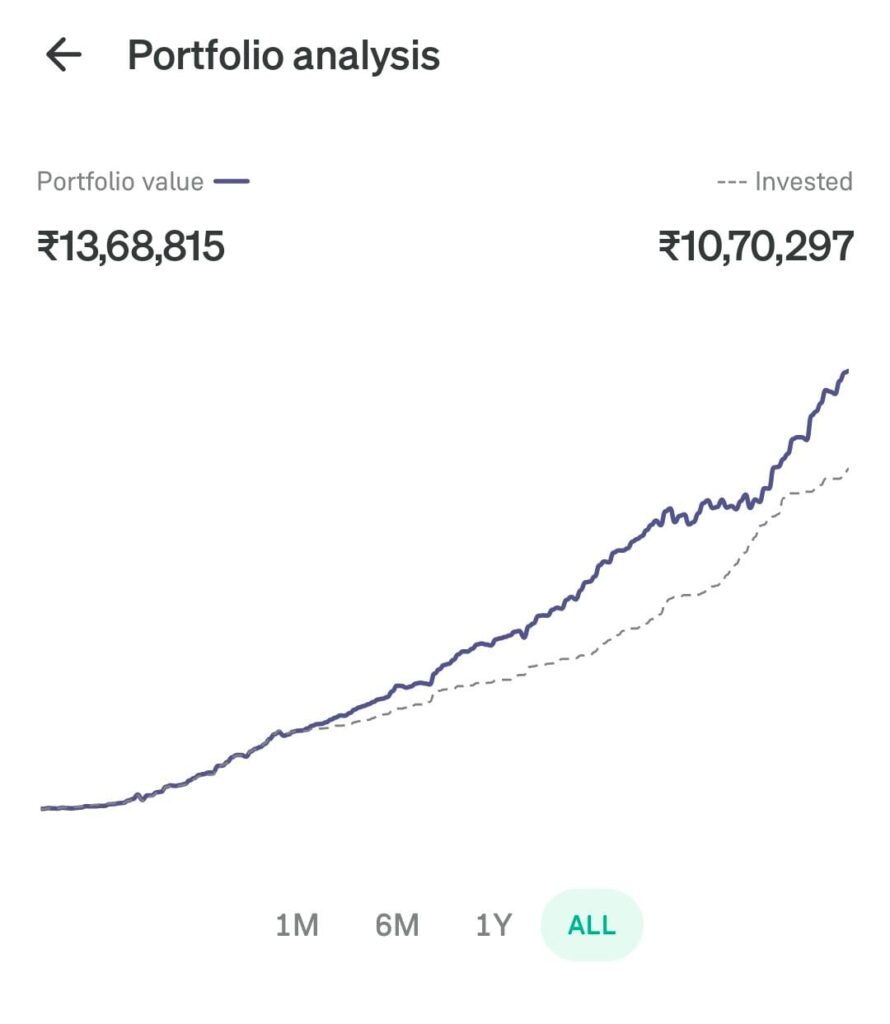

Total investment of 10.70 lakh would become 13.68 Lakh till jun 2025 with a return of 19.5% CAGR

My Current Mutual Fund Allocation ::

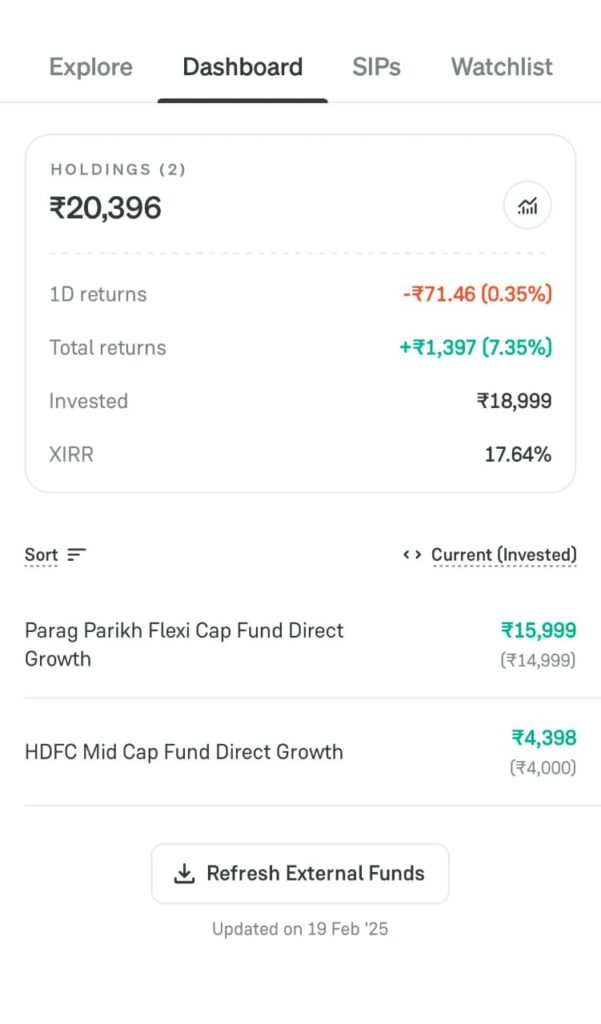

My Spouse account ::

Recently opened my spouse account and having corpous of 20k with 17.60% returns XIRR.

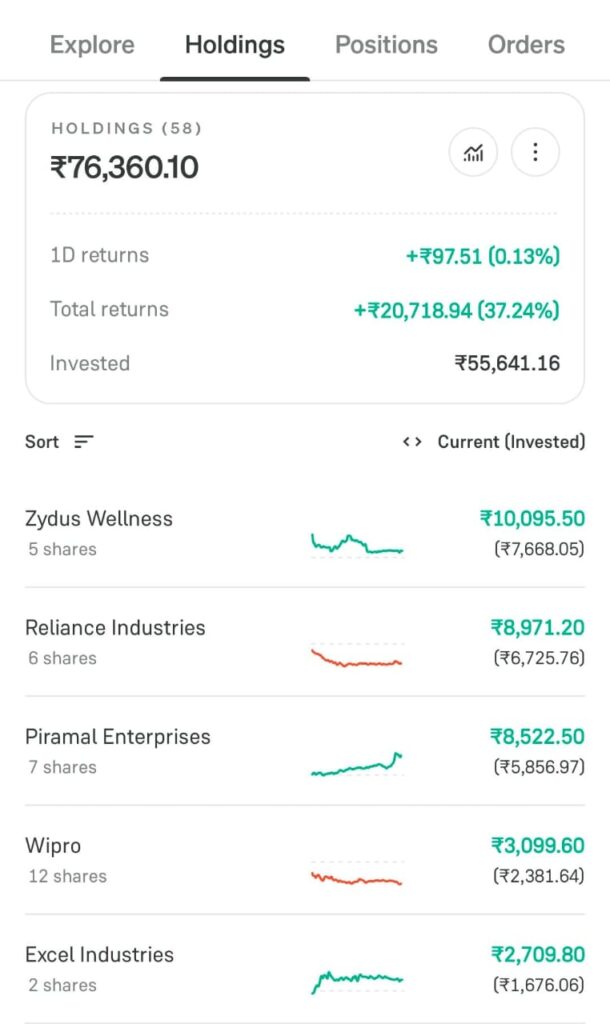

2) My STOCK Portfolio :: 92,000

I am having 76k portfolio in Direct Stocks but not for trading its only for long term investing. Having return of 37%. also booked profit of 30k previously.

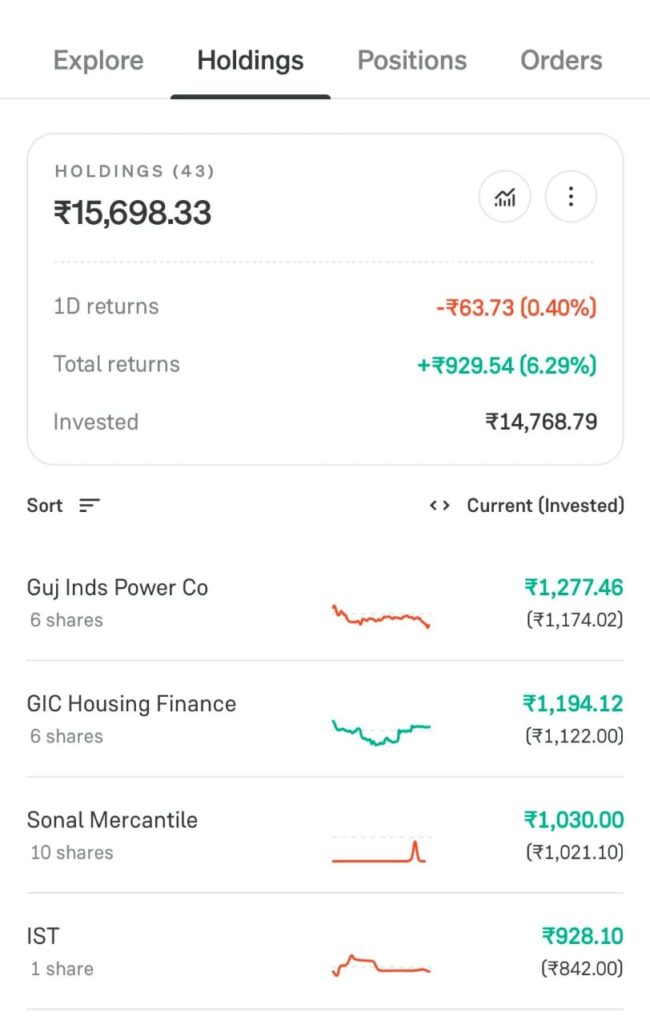

My Spouse account ::

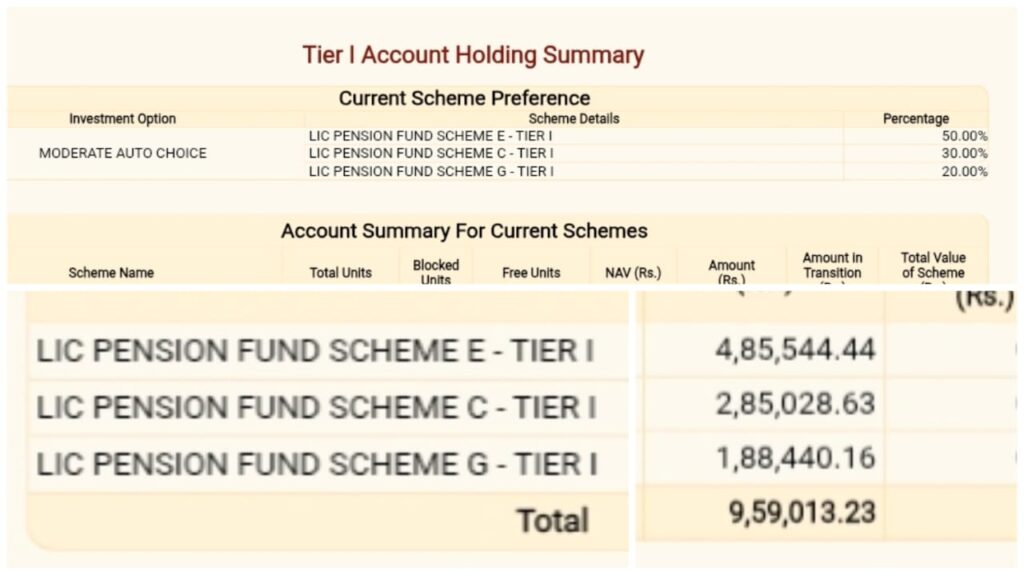

3) My NPS Holding :: 09.59 Lakh

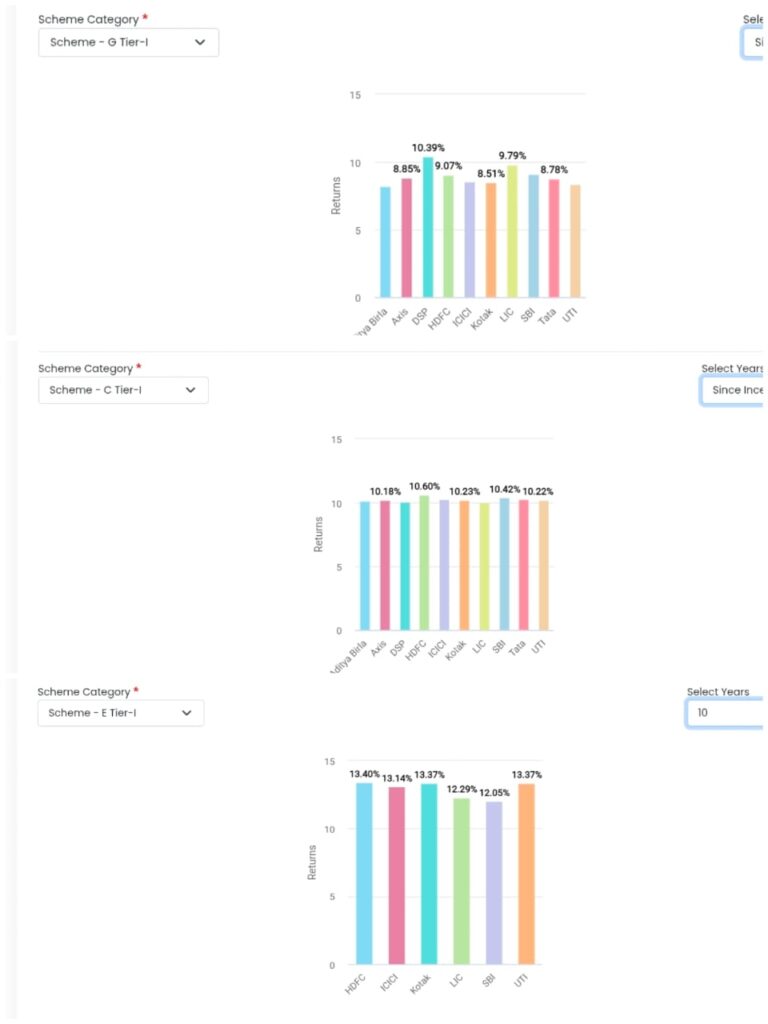

I am also investing some of my investments in NPS account & having descent return of around 11-12 on my investments. Now the question is how it would be possible?

Whereas most of people earn 7-8% in their NPS deposit. At same time i earned 10-12% in my NPS account. Because i have changed my NPS scheme from “Conservative” to “Aggressive” that means my 50% of investments goes to equity, 30% in Corporate bonds & 20% in Govt. Bonds.

Look at my account statement below…

Total amount invested 7.56 lakh would become 9.59 lakh with a Net Gain around 2.00 Lakh which means ROI of 26.80%.

I hope you will be motivated with my journey. if u have any question regarding SAVING, BUDGETING & INVESTING feel free to comment below, thanking you…

Haha, 40k salary to 24.4Lakh investments in a few years? Only possible if you live like a monk on one side and turn into a market wizard on the other! Impressive dedication to cutting expenses (3000/month Other is a joke!) and brave lumpsums during corrections. Reminds me to maybe stop buying that extra coffee. Well done on the Railway job and smart investing! Now, if only the dream of becoming Richest person in the community comes with a built-in private jet… keep aiming high! 🚀🤑ai watermark removal

3000 is rent bro, (room sharing)

total expense is 7000, it wil be managed happily 🫠